6055 The IRS has created two sets of codes in order toHome 18 1095C Codes 18 1095C Codes For more information on how we can support your ACA reporting needs click here any month for which the ALE member checked the " No " box on Form 1094C, Part III, column (a)) For more information, see the instructions for Form 1094C, Part III, column (a)614 PM What does 1H mean on form 1095C received from my employer?

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

1095c form codes 2f

1095c form codes 2f-Each Form 1095C would have information only about the health insurance coverage offered to you by the employer identified on the form If your employer is not an Applicable Large Employer, it is not required to furnish you a Form 1095C providingThe IRS requires Applicable Large Employers to report their employee's health coverage information on Form 1095C While reporting this information, employers must be clear about the Codes to be entered on ACA Form 1095C Previously, we've reviewed the INS and outs of ACA form 1095C For the tax year , IRS has anticipated new codes

United Benefit Advisors Home News Article

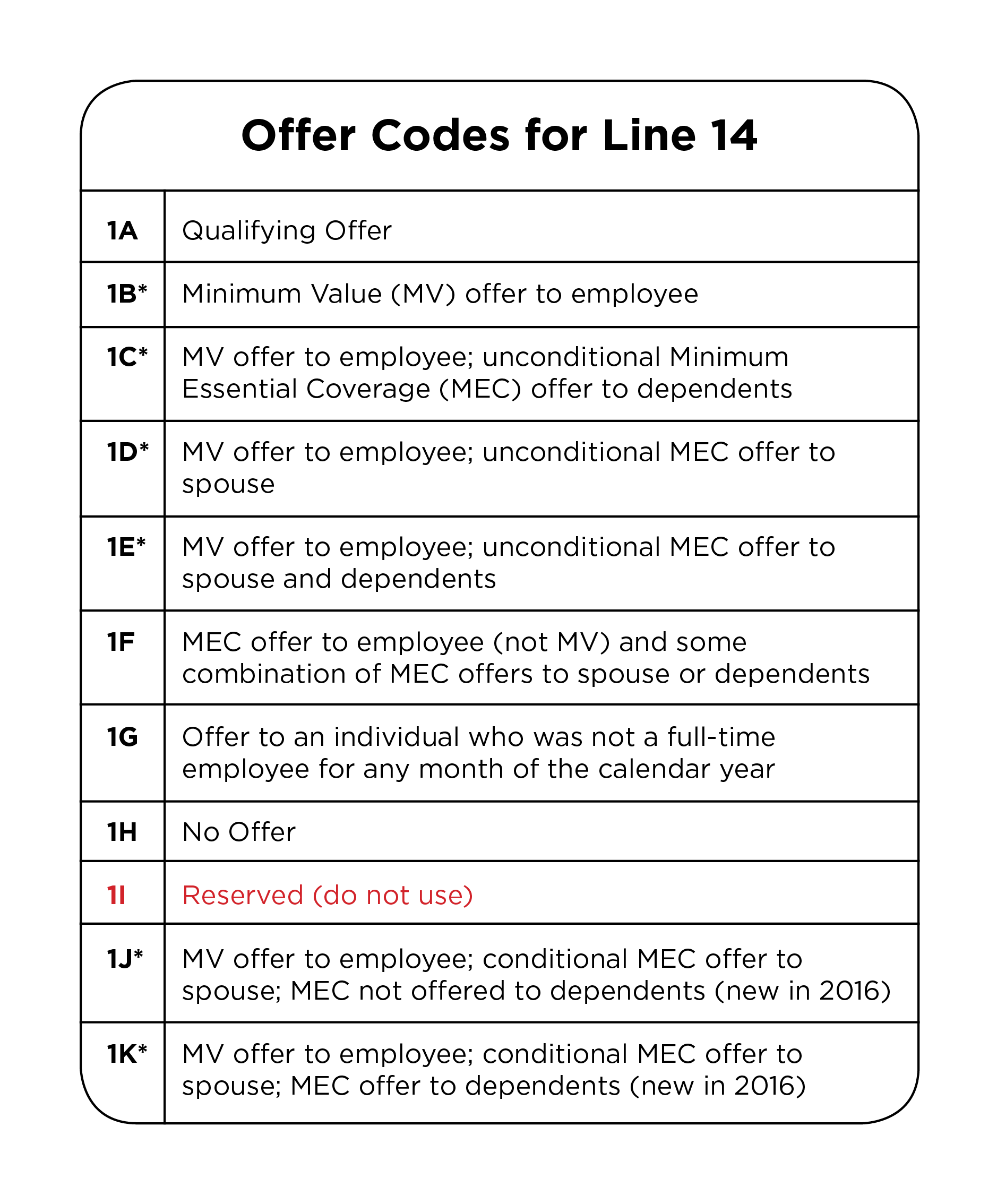

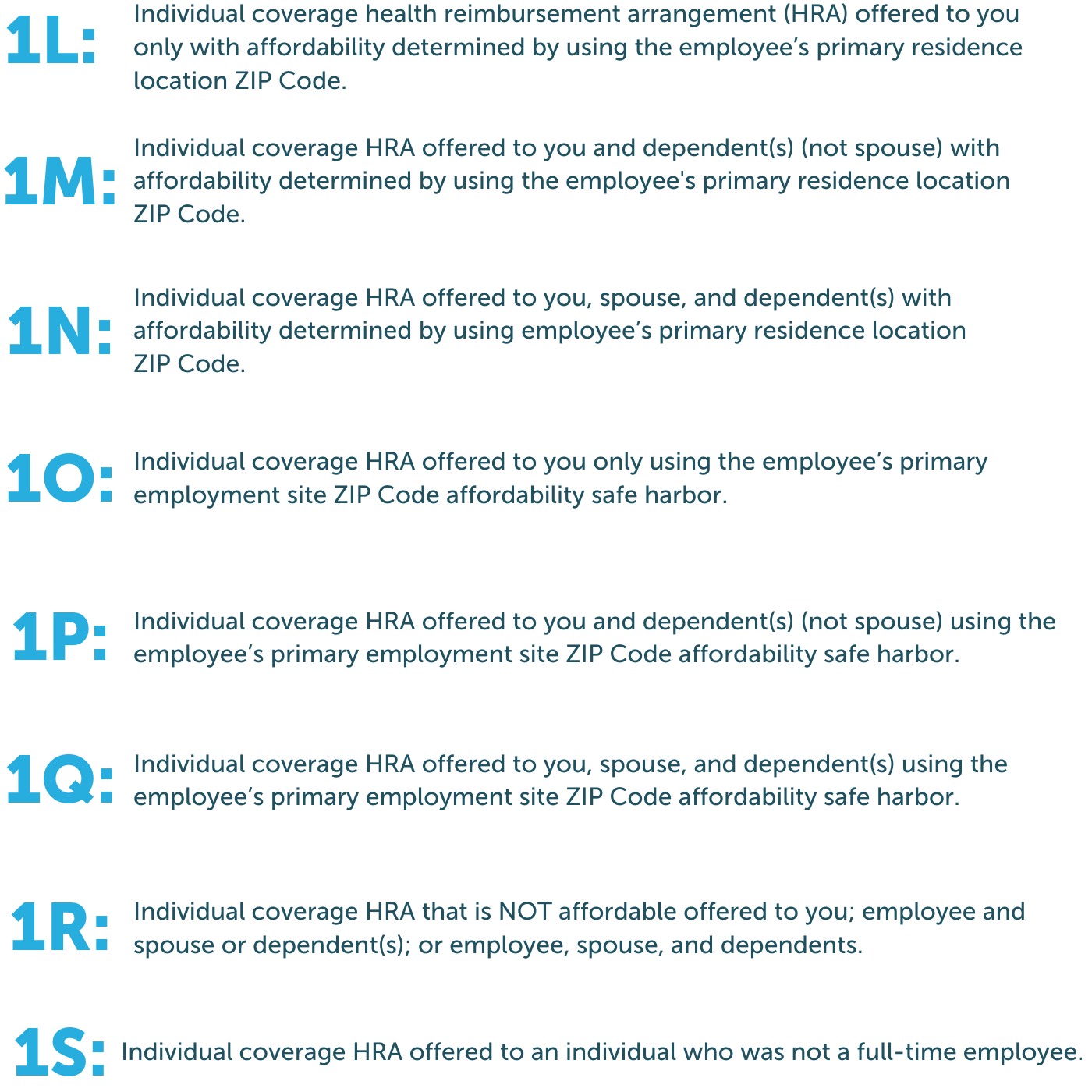

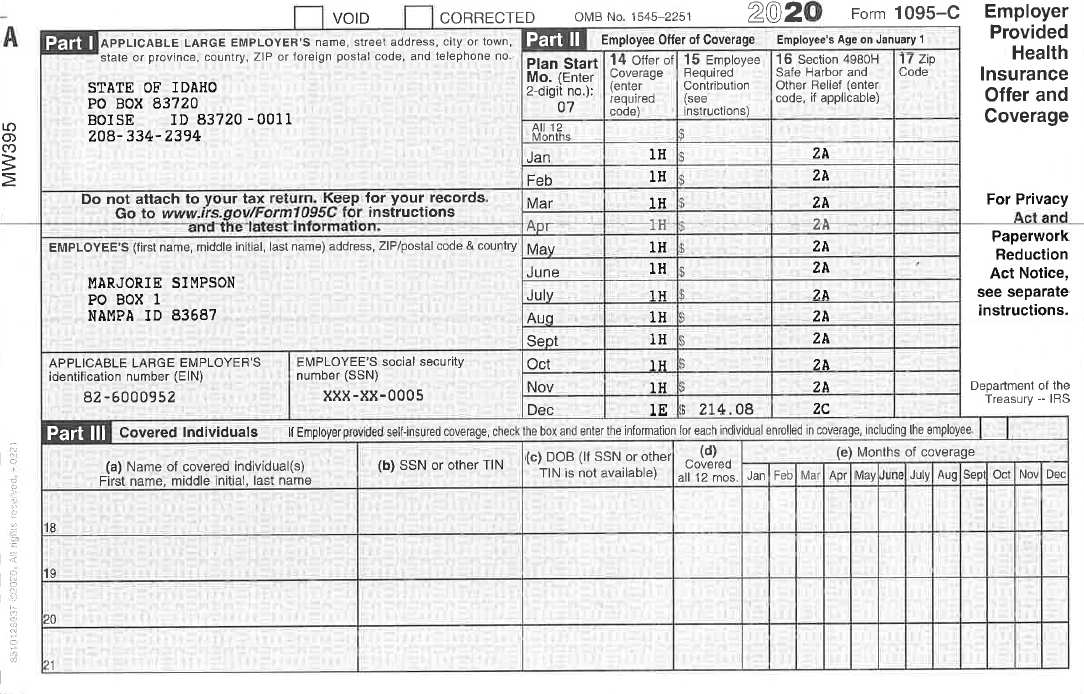

The IRS has added two new codes on Line 14 of the ACA Form 1095C for meeting the mandated ICHRA Reporting Requirements!Line 14 Codes SelfInsured Employer with NonFT EE A few notes regarding selfinsured coverage •All employees who enroll in selfinsured coverage must receive a Form 1095C This includes nonfulltime employees per the below scenario •Employers are required to complete all three parts of the Form 1095C only forCode Series 2—Section 4980H Safe Harbor Codes and Other Relief for ALE Members (Form 1095C, Line 16) CODE SERIES 2* 2A Employee not employed during the month Enter code 2A if the employee was not employed on any day of the calendar month Do not use code 2A for a month if the individual was an employee of the ALE Member on any day of the calendar

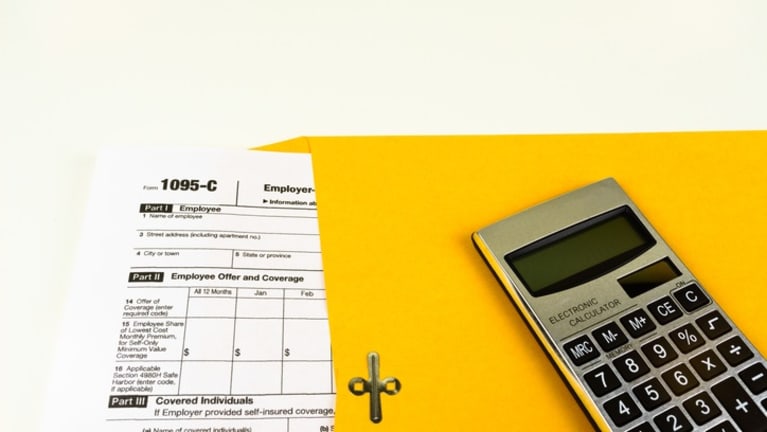

Choosing Form 1095C Codes For Lines 1416 Understanding how to select Form 1095C codes for lines 1416 can be challenging Managing ACA compliance all year is demanding enough, but it's crucial to choose accurate codes for Forms 1095C Entering inaccurate codes can result in ACA penaltiesLine 14 of IRS Form 1095C lists a code that describes whether an employee was offered coverage by their employer, the type of the coverage offered, and for which months the coverage was offered The form generation feature in the Zenefits ACA Compliance app will automatically input the applicable code, which specifies the type of coverage, if any, offered to the employee, theA There are a number of Code Combinations on Form 1095C, and the correct Code Combinations must be accurately reported on lines 14 and 16 For a breakdown and explanation of the codes, their meanings, and when to use them, read our post on the 1095C codes For the tax year, new codes have been released due to the COVID19 pandemic Q

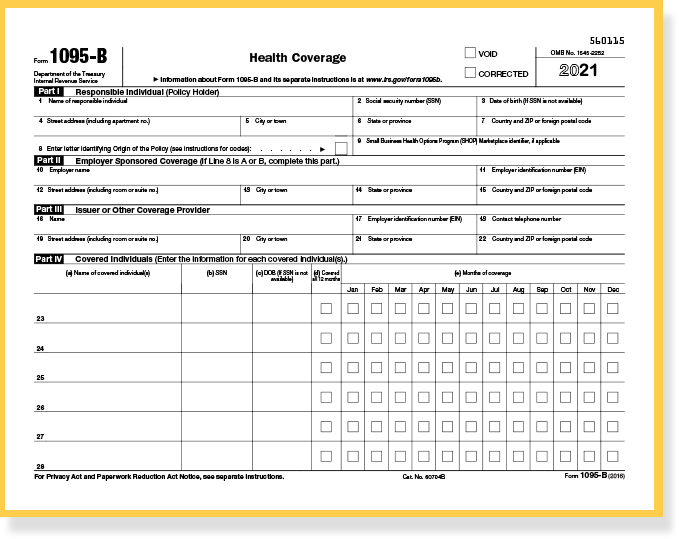

IRS Form 1095C Draft was released for the 21 Tax Year with changes What are the Changes to Form 1095C?You are receiving this Form 1095C because your employer is an Applicable Large Employer subject03 Code Series 1 – Line 14 05 Code Series 2 – Line 16 06 Filling Out Form 1095C Page 2 Want to learn more about preparing and filing Forms 1094C and 1095C?

2

United Benefit Advisors Home News Article

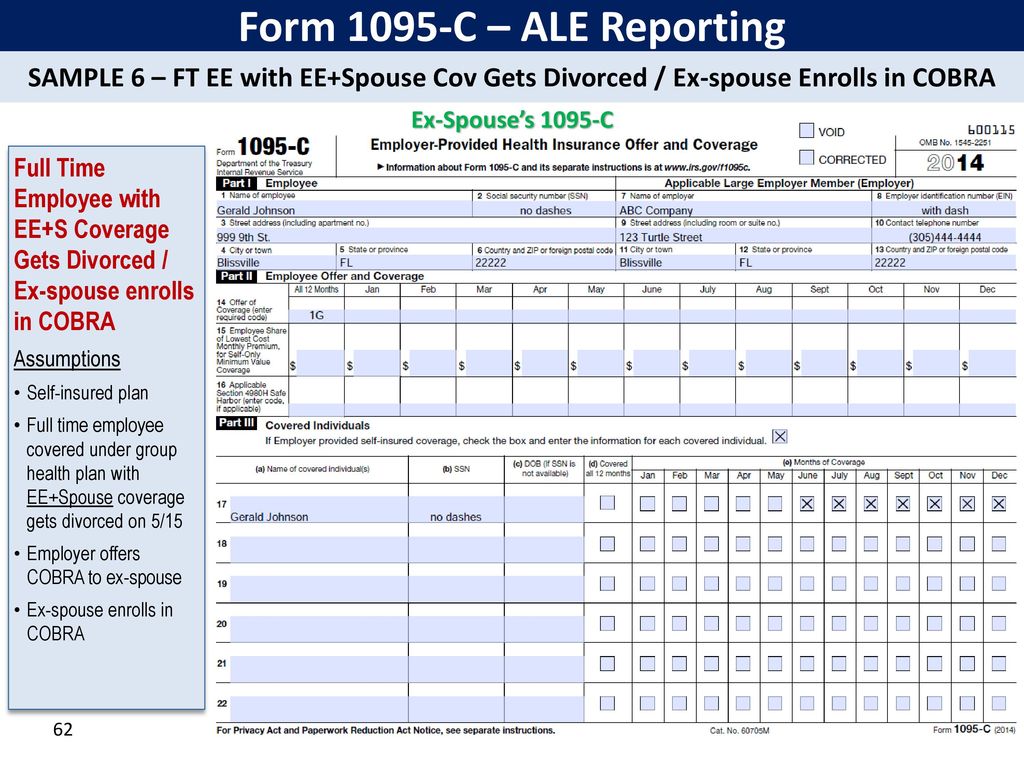

Form 1095C, Part II, the ALE Member must enter code 1G on line 14 in the "All 12 Months" column or in the separate monthly boxes for all 12 calendar months, and the ALE Member need notYou are partially correct Code 1H, see attached, means ''No offer of coverage to the employee Or the coverage offered did not qualify as ' 'minimum essential coverage '', which is a description used in the ACA If you're covered by any of the following types ofThe Form Below is Form 1095C from the IRS website This guide will explain each piece of the form and help you determine the proper codes for the fields in Part II Shown below in blue, Parts I and III are comprised of lines 113 and 1734, respectively These sections are easy enough, just employee information

21 Aca Form 1095 C Line 14 16 Code Sheet By Acawise Issuu

Aca Code Cheatsheet

Form 1095C Decoder If you were a fulltime employee working 30 or more hours per week or enrolled in healthcare coverage from your employer at any point in , you should receive a Form 1095C If you received a Form 1095C from your employer and you're not sure what the codes mean, check out our 1095C Decoder to learn moreThe IRS has issued Form 1095C, EmployerProvided Health Insurance Offer and Coverage, for ALEs to satisfy the reporting requirement under Code §In addition to Line 14, employers must enter codes on line 16 which provide additional context around the type of coverage offered or why an offer was not made Below are the different codes that can be entered on line of the 1095C 2A This code is simple;

Draft 21 Aca Reporting Forms Issued By Irs The Aca Times

2

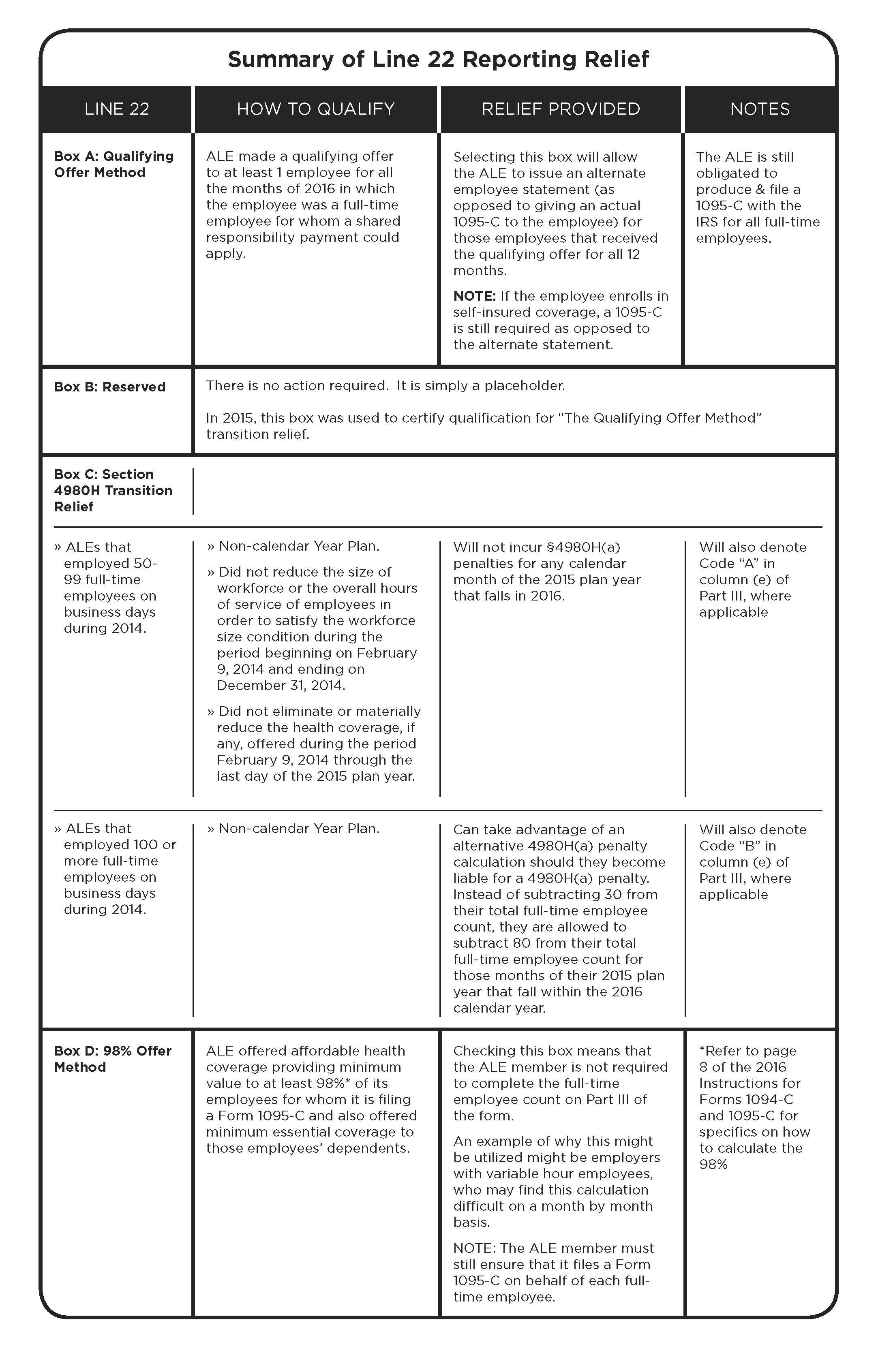

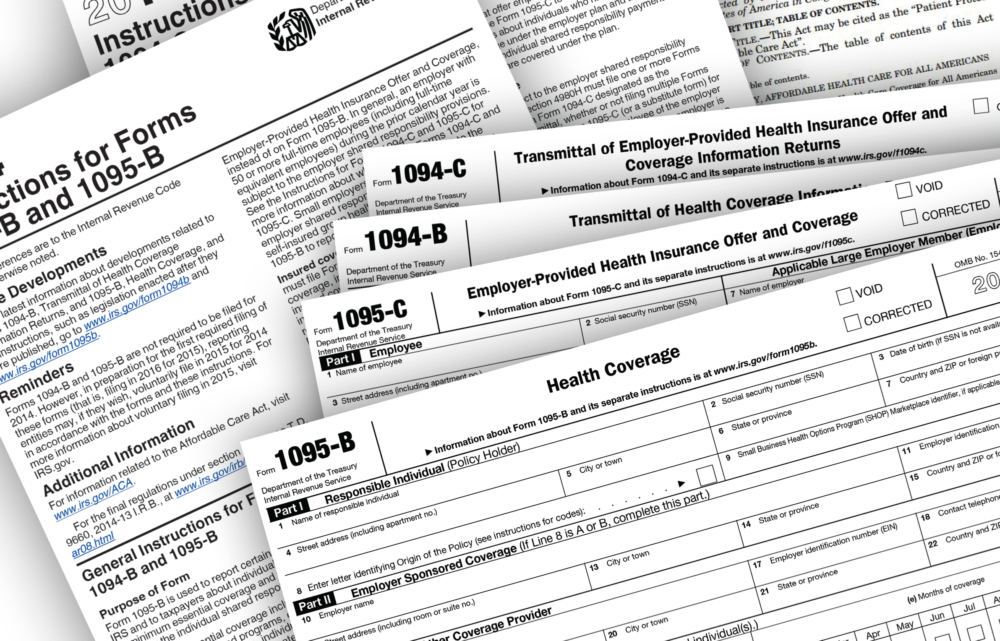

The 1095C forms submitted to the IRS should be accompanied by Form 1094C ACA Form 1094C provides summary information on an applicable ALE to the IRS Forms 1094C and 1095C are used in combination with the agency's automated Affordable Care Act Compliance Validation (ACV) System to determine whether an ALE owes a payment under the5 ACA Form 1095C Line 16 Codes, Section 4980H Safe Harbor and Other Relief Line 16 of Form 1095C is used to report information about the coverage that an employee enrolled in, and how the ALEs meet the employer shared responsibility "Safe Harbor" provisions under Section 4980HRegister for our BernieU course, Intro to Forms 1094C and 1095C, where we cover everything from

What You Need To Know About Aca Annual Reporting Aps Payroll

United Benefit Advisors Home News Article

Key Changes to ACA Form 1095C The IRS added the values for the two previously reserved codes in Code Series 1, used on line 14 Form 1095C has been updated so that an ALE can report the ICHRA coverage that is offered to an employee Codes DescriptionIRS Form 1095C is basically used to meet the Section 6056 large employer play or pay requirement and to help determine if an individual is eligible for a premium tax credit It is the employer's responsibility to complete the form for each eligible fulltime employee, and they are required to send a copy to the employee and file a copy with1095C C Form Instructions The IRS has released final Forms 1094C and 1095C (C Forms) and final instructions for the C Forms for the 17 tax year (Final Forms 1094/1095B, but not the instructions, have also been released We'll cover those items in a separate article after the final instructions become available)

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

The New 1095 C Codes For Explained

To correctly determine their 1095C Part II codes Some even simply mark all fulltime employees 1A in Line 14 and 2C in Line 16 with no premium amount required to be listed Form 1095C Part II Employee Offer of Coverage Part II of the IRS Form 1095C includes three parts Lines 14, 15 &All Form 1095C Revisions And here are some 1095C pointers Use the 1094C form to tell the IRS about whether you offered workers Minimum Essential Coverage (MEC) You may see the term ALE used in the 1094 and 1095 instructions This means Applicable Large Employer As in an employer who must file the formsThe IRS has released a revised Form 1095 C introducing new codes for reporting Individual Coverage HRAs and new lines for entering the related information The changes to IRS Form 1095 C are explained below New codes to be entered on Line 14 Two new codes are introduced by the IRS to enter on Line 14 of Form 1095 C These codes range from 1T

Accurate 1095 C Forms Reporting A Primer Integrity Data

Overview Of 1095c Form

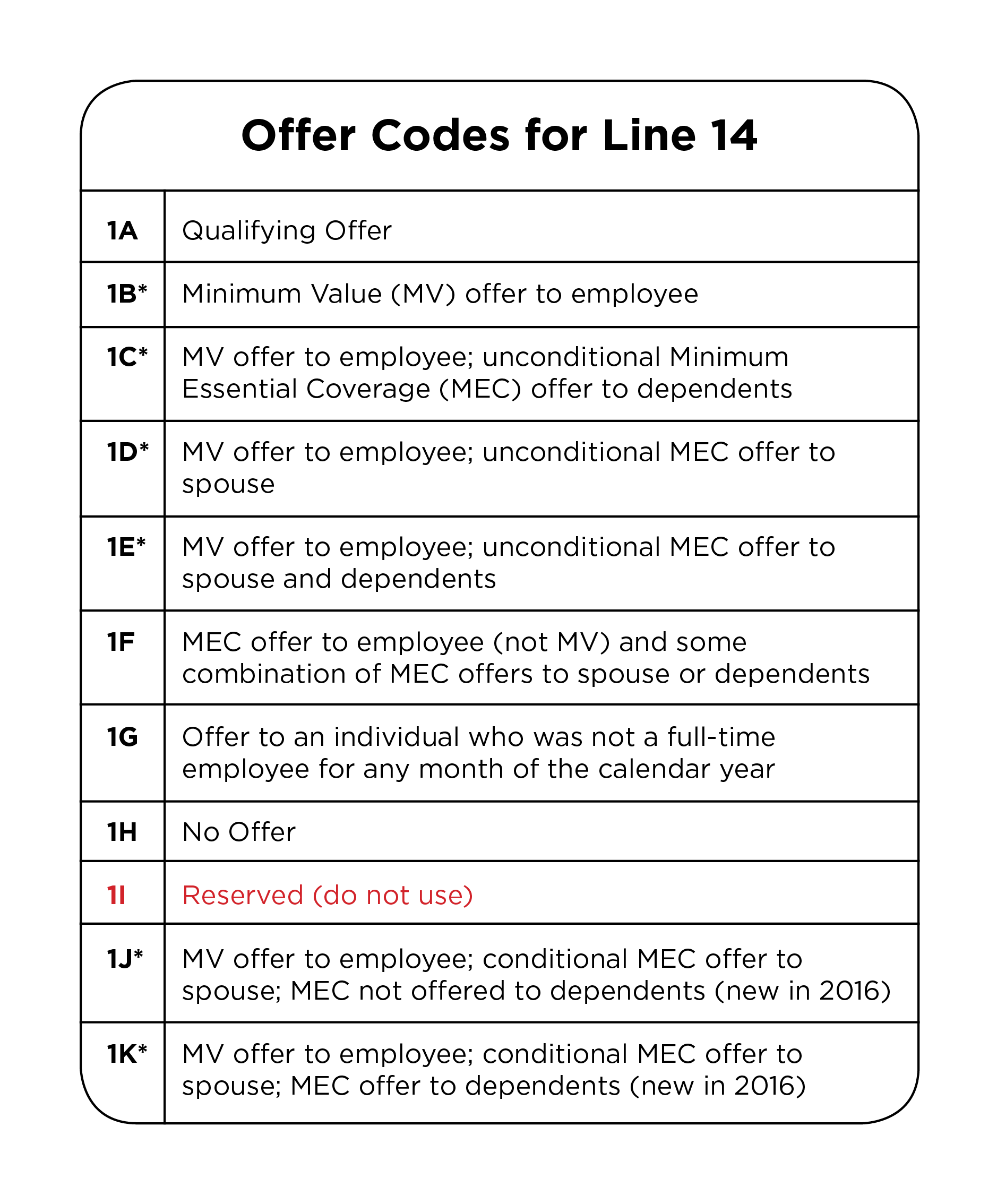

Form 1095 Code Definitions Lines 14, 15, and 16 Line 14 Offer of coverage code 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for selfonly coverage equal to or less than 95% mainlandForm 1095C contains a series of codes that indicate employee health insurance coverage For traditional health coverage, applicable codes include 1A through 1H If using a benefits administration software that automates the Form 1095C process, the software should populate the codes for the months they were enrolled in coverageLearn More Have questions about meeting the ACA Reporting in 22 with the new changes?

Changes Coming For 1095 C Form Tango Health Tango Health

The Abc S Of Forms 1095a 1095b And 1095c Aca Gps

ACA Form 1095C Codes Cheatsheet Line 14, 16 Codes › See more all of the best online courses on wwwacawisecom Courses Posted (1 week ago) ACA FORM 1095C CODE SERIES The IRS has designed two sets of ACA codes to provide employers with a way to describe health coverage offers on Form 1095CEach code indicates a different scenario regarding an offer ofForm 1095C, Line 15 Employee Share of Lowest Cost Monthly Premium for Self Only Minimum Value Coverage Complete line 15 only if code 1B, 1C, 1D, or16 These lines together paint a picture

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

1094 C 1095 C Software 599 1095 C Software

Form 1095C Line 14–Code Series 1 A Series 1 code must be entered in line 14 to indicate the type of coverage offered (or no coverage offered) to the employee and family Enter a code for each month, or enter one code in the "all 12 months" box if the same code applies for the entire calendar year "Spouse" means the employee's spouse6056 If the employer selffunds its plan (s), the employer also will use Form 1095C to satisfy the additional requirement under Code §Calculating the 1095C Lines 1416 codes is one of the more daunting tasks of ACA reporting For 15 tax reporting, many employers found themselves relying on their "best guesses" to correctly determine and complete their 1095C Part II codes UnifyHR has created a Guide to provide an overview of IRS Form 1095C and the required Part II Codes to empower you with the

2

1095 C Employer Provided Health Insurance Offer Of Coverage

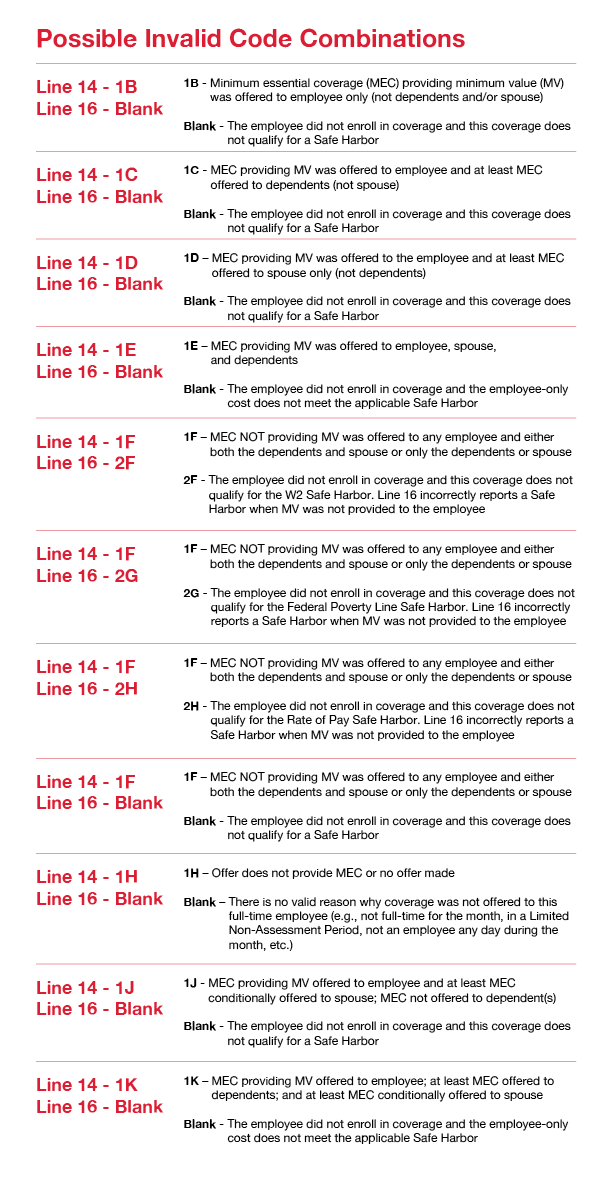

Code 1A alert On , the IRS revised ACA reporting guidance on how employers document a qualifying offer of health coverage on Form 1095CThe 1095C form is typically the form used to fulfill the ALE's obligation to furnish a statement to employees, former employees, nonemployees and retirees of an ALE The Patient Protection and Affordable Care Act ("PPACA") consists of the individual mandate and the employer mandate (which has been repealed as of )Eleven IRS Form 1095C Code Combinations That Could Mean Potential Penalties The 1095C form is used by employers with 50 or more fulltime and fulltime equivalent employees (also referred to as applicable large employers or ALEs) to report information required under Section 6056 of the Affordable Care Act

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

18 rowsForm 1095 C Line 14 Offer of Coverage On Line 14, employers should choose the applicable codeFor the months April through December, on Form 1095C, Employer A should enter code 1H (no offer of coverage) on line 14, leave line 15 blank, and enter code 2A (not an employee) on line 16 (since Employee is treated as an employee of Employer B and not as an employee of Employer A in those months), and should exclude Employee from the count of total employees and fulltimeInformation from Form 1095C will also be used in determining whether an individual is eligible for a premium tax credit Line 14 of the 1095C is where an employer reports an offer of coverage that is or is not made to an employee The offer is reported by using one of nine codes, which are referred to as "Code Series 1" codes

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

Aca Code Cheatsheet

A) Place Code 1A in any box on Line 14 where Code 1E would otherwise be placed b) Leave Line 15 (Employee's Share of Lowest Cost Monthly Premium) blank c) Provide each employee who received a qualifying offer for all 12 months a statement (rather than a copy of her/his Form 1095C) that includes • Identifying information about theWhen reporting Form 1095C, you must be aware of Section 4980H safe harbor and Offer of coverage codes Employers must file Form 1095C for each of their employees, as each provides information on the employee's health insurance coverage for each month of the yearForm 1095C Line 16 Codes are used to report information about the type of coverage an employee is enrolled in and if the employer has met the employer's shared responsibility Safe Harbor provisions of Section 4980H The table below explains the code series 2 to be reported on line 16 of Form 1095C Codes

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Aca Elite Generate Codes E File 1095 C Forms

Form 1095C, employers should consult the Internal Revenue Service's Instructions to Form 1095C for a complete description of the indicator codes • An employer may use 2F, 2G and 2H to indicate that an employee declined an offer of coverage The code an employer uses depends on the reporting method or form of Transition Relief indicated onForm 1095C is used by applicable large employers (as defined in section 4980H(c)(2)) to verify employersponsored health coverage and to administer the shared employer responsibility provisions of section 4980HIt means that the employee was not employed It typically is seen with an accompanying 1H on line 14

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

New 1095 C Codes For Tax Year The Aca Times

Irs Announces Changes With Aca Reporting Forms And Instructions Onedigital

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

What Your Clients Need To Know About Form 1095 C Accountingweb

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

Example Of 1095 C

Irs Form 1095 C Codes Explained Integrity Data

Irs Issues Draft Form 1095 C For Aca Reporting In 21

2

2

Code Series 2 For Form 1095 C Line 16

Aca Reporting Faq

2

Aca Code Cheatsheet

Eleven Irs Form 1095 C Code Combinations That Could Mean Potential Penalties

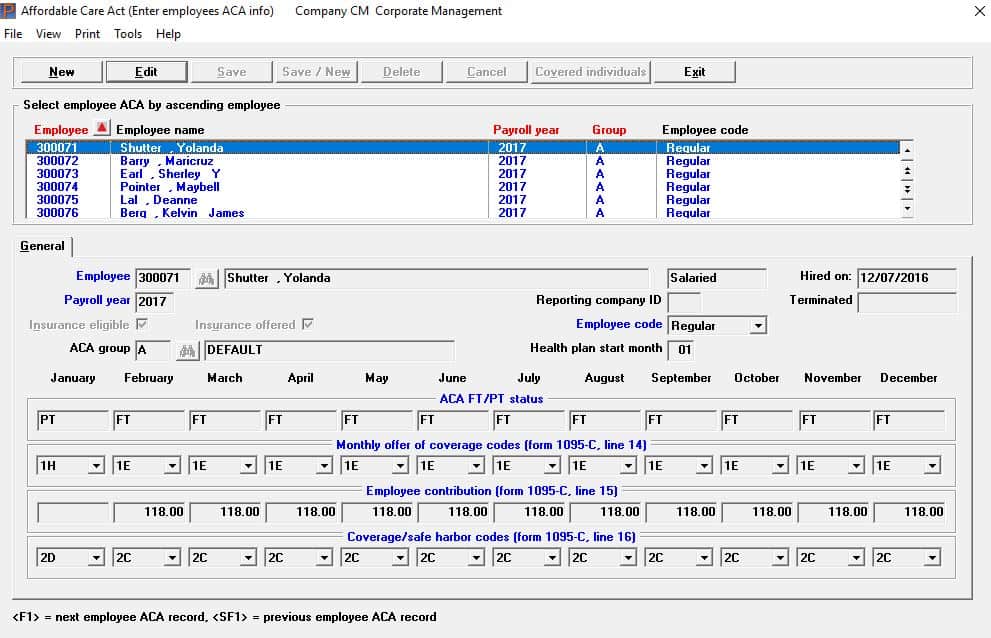

Aca And The Vista Hrms Fall Update

2

Form 1095 C Guide For Employees Contact Us

Aca 1095 C Code Cheatsheet

Section 6056 Large Employer Reporting Ts1099 Ts1099

2

Sample 1095 C Forms Aca Track Support

Toast Payroll Completing Boxes 14 15 And 16 Of The 1095 C

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

1095 C Form Official Irs Version Discount Tax Forms

Eleven Irs Form 1095 C Code Combinations That Could Mean Potential Penalties

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

2

1095 C Software For Tracking Reporting Passport Software

Affordable Care Act Processing

What Your Clients Need To Know About Form 1095 C Accountingweb

2

1

Changes Coming For 1095 C Form Tango Health Tango Health

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Aca Code Cheatsheet

2

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

1094 C 1095 C Software 599 1095 C Software

Irs Form 1095 C Codes Explained Integrity Data

1

The Codes On Form 1095 C Explained The Aca Times

Employers Are You Unsure Of The Coding On Forms 1094 C And 1095 C The Aca Times

Annual Health Care Coverage Statements

Form 1095 C Released New Codes New Deadlines

Toast Payroll Common Combinations Form 1095 C Codes

2

2

1095 C Examples

Clearing Aca Confusion Which Employees Get Irs Form 1095 C

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

2

trix Irs Forms 1095 C

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

Code Series 1 For Form 1095 C Line 14

Changes In 21 Aca Reporting Employment How To Plan Health Insurance Coverage

Aca Code Cheatsheet

Irs Form 1095 C Codes Explained Integrity Data

Updates To Form 1095 C For Filing In 21 Youtube

Sample 1095 C Forms Aca Track Support

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Streamlined Aca Reporting Methods Newfront Insurance And Financial Services

2

1095 C Template Fill Online Printable Fillable Blank Pdffiller

Irs Form 1095 C Codes Explained Integrity Data

Common Mistakes In Completing Forms 1094 C And 1095 C

Form 1095 A 1095 B 1095 C And Instructions

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer

2

United Benefit Advisors Home News Article

2

Aca Code Cheatsheet Release Notes

1095 Software Aca Software And 1095 C Irs 6056 Compliance

1095 C Faqs Mass Gov

0 件のコメント:

コメントを投稿